MCM April 2019

2018 Conference, Nadi, Fiji

2018 Senior Leadership Programme

Strategy Workshop for Regional Tax Organisations, 10 - 13 February 2018

Workshop on Security for AOE, Grenada, 22 - 26 January 2018

2017 Conference, Accra, Ghana

2017 TOIT

2016 Conference, Bridgetown, Barbados

2015 Conference & General Meeting

2015 ALP & CTAC delegates in UK

2015 Conference - slide show 1

2014 Conference proceedings

2014 Conference - Directory of delegates registered

2014 AMP & CTIC Programmes

2013 Conference, Kigali, Rwanda

2012 Conference & General Meeting, Floriana, Malta

2011 Conference, Colombo, Sri Lanka

2010 Conference, Abuja, Nigeria

2010 CTIC programme

2010 AMP programme

2009 Conference, Malawi

2009 AMP & CTIC programmes, UK

2008 AMP & CTIC programmes, UK

2007 Conference, Nairobi

2007 AMP & CTIC Programmes, UK

2007 CMD Programme, Kingston, Jamaica

2006 AMP & CTIC Programmes, UK

2006 Conference, Port Louis

2005 Conference, Ottawa

2004 Conference, Lusaka

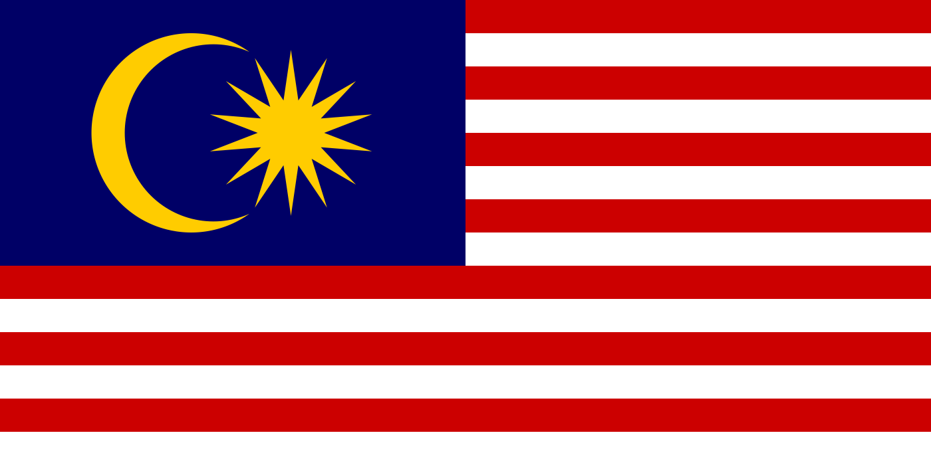

2003 Conference, Kuala Lumpur

2002 Conference, Cape Town

1999 Conference, Belize City

1993 Conference, Islamabad

1990 Conference, Mauritius

1989 Conference, Nicosia

1984 Conference, Western Samoa

Memories

CATA people